What is representativeness heuristic?

A representativeness heuristic is a bias in which an individual categorises a situation based on a pattern of previous experiences or beliefs about the scenario.

Umm, if that was a bit heavy, visualise this:

You see a person on the road. He is wearing a starched extra-white shirt (shirt not tucked in). He has an expensive cellfone is his hand. There is a very visible thick gold chain in his neck and an equally thick gold bracelet in his wrist. He is also wearing numerous bejeweled gold rings in his fingers and has a big tika on his forehead. Got the picture in mind? Well, if you suck at visualising stuff, its someone like this:

Now I ask you; What do you think does a person like this do?

a) Software Engineer

b) A local neta of a political party

Chances are, you will choose option b. (Btw, the person in the photo is actually an MLA from Pune)

Now is it a rule that a software engineer cannot dress like this? No! Still, we associate someone like this with a politician, based on our past observations and experience. This is representativeness heuristic. But, its not necessary that our conclusion, based on past observations, may be correct everytime..

Representative heuristic and the market

One can see this phenomenon happening in the market a lot of times. Some examples:

- Tata Steel declares phenomenal quarterly results and on that day, all steel stocks prices hit the roof. (just an example, but it happens in a lot of sectors)

- IIP numbers show consumer durables sector doing well and all consumer durable stocks go up on that day. (has happened recently)

- Rubber prices come down for a brief period and all tyre stocks go up.

Now, it should be noted that in this phenomenon, all related stocks go up, including the ones which do not deserve to! One can see the representativeness bias in the market on numerous occasions..

Representative heuristic and delisting

Finally! Coming to the point!

In Feb 2011, Altas Copco announced its intention to delist. What followed was very surprising and quite rare in the Indian market.. The promoters were fair and generous to the minority shareholders! ;-) They gave an excellent exit price to the minority. (Also, hats off to JM Financial guys for managing this delisting beautifully!)

Now this is where the representativeness bias has creeped in, imho..

The market seems to think that

1) Just like Copco, all MNCs will be fair and generous to the minority.

2) Hence it makes sense to buy all these delisting stories and make a killing!

If you think that this is not what the market thinks, look at the price movement in such stocks, after Copco's delisting succeeded..

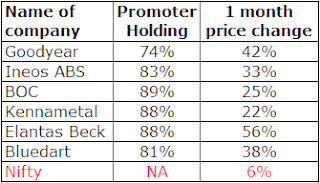

|

| Data sourced from Edelweiss Website. In some cases, the calculation seems inaccurate. Anyways, I am not interested in strict numbers, but in what they represent. |

As can be seen, after Copco's generous-hence-successful delisting, the other delisting candidates have shot up, outperforming the index. This is indeed representative bias..

So what do we do about it?

- It could very well be the case that what the market thinks is right and the MNC parents of these delisting candidates will be as generous as Atlas Copco. However, it is not necessary! Just because Atlas Copco was generous does not mean everybody will be equally generous.

- One should adopt a logical approach towards analysing delisting cases and not be swayed or affected by biases. Dont take things for granted! More on playing delisting cases here.

Cheers and happy investing!

21 comments:

hi,

wow! that was an adept example and you definitely rock as a teacher!

Your students are lucky to get you!

nice post

thanks

Shazia

:-)

Thnx Shazia..wonder what my students say! :-)

Cheers!

Neeraj

Sir,

u conviniently left Disa in your list of examples although u have urself talked about its delisting angle in the post ..

Also since u seem to b keen on biases and jargons ... if i may just add a bit... in the case of Disa u have talked about the exit price of Rs2950 (approx) , i hope while buying this is not what u are expecting out of the stock .. This could also be termed as anchoring bias...

Good example Mr. Marathe

Dear anonymous (why remain anonymous btw??),

Thnx for a very honest and fair comment..

1) I did not 'conveniently' leave Disa out..(why would i do that???) Disa is not an immediate delisting case, unlike others. unless the legal tangles wid SEBI are resolved, there is no possibility of delisting. thats why i did not write about it in this post..(and i also have a specific post on disa)..

2) Disa came to my attention as a business, not a delisting case. delisting is just another angle and not the primary reason to buy the stock..

3) in case of Disa, i have nowhere talked about ANY exit price..2960 or otherwise. It was bought primarily since i felt it was cheap at that market cap..

Plz do keep commenting..u talk straight, which is gr8..

cheers!

Neeraj

@ Ani,

Thnx Mr.Kulkarni :-)

Cheers!

Neeraj

Dear Mr. Marathe & Mr. Kulkarni

Just curious to know why this sudden show of respect & formality?

Anyway, nice write-up, Neeraj

Thanks and regards

-Mr. Kulkarni

LOL..

thank u another Mr.Kulkarni..

Cheers!

Neeraj

Hi, luks like sum1z regular these days! ,thx 4 d encouragement...truly need it when mr.market is upset wid me....:(...hopefully u've had a look at the spinoffs of the season- biogreen industries,alembec and indiabulls real estate,wot r ur views ? (i'm quite sure there are some intereresting oppurtunities here). Just read rohit's post on the economics of brokerage biz, thinking along those lines any thoughts on sumedha fiscal yet? .Thanks for ur views on ceejay (p/e-3,p/b-.45 and div. yield-7% and mkt. Cap of 6 crore)...i'll probably seek a bigger margin of safety while entering into microcaps from now on,speaking of which what r ur views on these 2 turnaround cases-dhandapani finance (the story seems 2 be getting better with its first cash eps in 5 years and with a representative ofpnb on the board and a couple of management bigwigs out,especially the head honcho who was demanding outrageous high pay for a co.in cdr, i mean talk about timing! ) and himachal fibres (yarn producer,quite voilatile stock, p/e-3 and most of the mkt cap covered by cash and cash equivalents,looks like an interesting case new promoters initiating a cleanup of the old management and board and most of the 'debt' in the form of preffered shares or soon to be extinguished below par ).so any views on teesta yet? Just wondering what are the possibilities and scope of shareholder activism a la carl icahn/liquidations/acquisition in india? U no a gr8 way to screw the promoters( i mean i've seen very few instances like himachal fibres and that 'agarbatti' company ,the one mentioned on dalaal-street and atleast those situations seem to be working pretty well.There seem to be tremendous value unlocking oppurtunities here). ANYWAYS , WAS JUST READING SUM OLD POSTS- HAPPY ANNIVERSARY I GUESS,where do you teach ? I've just completed my 12th and am seeking a course where i can learn more about investing,any suggestions? Btw heres 1 on Disa- The numbers make us feel dumber , this situation makes the brain number, Oh teacher wake us from this slumber! (In short wheres the bargain in DISA). Plz help me kill the money matters idea(situation seems 2 stabilising,its selling below liquidation value,they are now focusing on working capital loans,the accused promoter has a majority stake,i mean its starting 2 seem like a low risk ,high reward situation,satyam got away wid much worse,wot do u think?)P.s being d shameless pig dat i am ,i intend 2 take u up on d drink offer sumday...lol...;p

Hey Rayhaan..

Nice to hear (a lot) from u :-)

and LOL LOL LOL and one more LOL for the poem!

Dude, u just passed 12th?? no hard drinks for u man..

regarding Disa, a few questions to set u thinking

1) Is it a company with niche and differentiating products?

2) does it have a professional and trustworthy mgmt?

3) does the industry scenario look attractive?

4) can one see growth happening?

5) is the company doing its best to capture and make the most of the opportunity at hand?

6) do the valuations make sense? do they have a good balance sheet and make cash?

7) temme, wat do u think disa's topline cud be 3 years from now?

regarding sumedha, i think its a v interesting story..but i just suspect that better stories are available..(not from the same sector of cors)

Himachal fibres shares havnt been trading for a month now it seems..and money matters is realllllly not for some1 like me..

and yaa..its been 1 year since i started boring ppl thru the blog..thnx for bringing it to my attention..lets party...u can have some coke :)

regarding ur further studies, it really depends on ur liking..(i am talkin bout gettin a basic degree n stuff..) if u r keen on doin ur MBA, think of MDI, where prof Bakshi takes a fantastic course.

cheers man

Neeraj

hi, thanks for the heads up on how to go about analyzing DISA. WHERE AND WHAT DO U TEACH?

i mean are there any great courses for learning security analysis at undergraduate level?

i cant wait to get the rest of my life started and am tired of waiting....:(.....and please help me understand the rationale behind money matters....as in what was the deal breaker...the uncertain status of the ongoing litigation,the off-books ,on books stuff or something else?

anyways just wondering whats your favorite style of investing- net-nets,deep value(like rohit), if-its -cheap-and-awesome-we ll -buy -it(a la ayush),growth, turnaround , spinoffs etc?

yes, himachal fibers is quite a volatile and illiquid stock.hopefully the price is good enough to compensate for the risk, what do you think?

just thinking at least if AJ decides to go into real estate , theres a good chance for wealth creation according to prof.bakshi s article (crossroads mall and sunteck realty).also atleast on a rough glance, it seems the dude has outperformed the pharma sector .for every AJ out therethere are hundreds of jagsonpals!

any thoughts on teesta and dhandapani?

p.s dude dont b so modest its one of the more awsum blogs out there and yeah any chance of a beer atleast?.....lol....i mean i ve barely gotten my demat account after 18 months of "semi-legal" trades in chachu"s name

BEERS,

BARNEY STINSON

Hey didnt know that Barney is u reyhaan..

anyway, i teach at MITSOB, ICFAI B-school and SIMS (all pune based B-schools)..i am not aware of any specific course on investing..u can try http://www.cbacademy.in if u find it to ur liking..

money matters mein i have a mindblock..i wont invest in a company where it is known that the mgmt has done wrong..i keep feeling that there might b a lot of factors which we do not know (as u have pointed out)

as regards my style, i dont have any! net-nets are hard to get (although i did get some in the fall of 2008), deep value; yes surely..cheap and awesome; rarely..growth; sure, but its a mixture of growth n value..special situations too work for me.

and beer is a-ok..where r u based? do send me an email on my id..

single malts (better than beers)

Neeraj

hi,

oops looks like the cats out of the bag....i like the barney stinson guy though....whats ur id?(couldnt find it)

my email id is shravanrayhaanpaul@gmail.com

im based in delhi

thanks for the clgzs, will have a look at them any chance ill be able to join a college that you teach in , before graduation?

anyways u didnt temme wot r ur thoughts on himachal fibres? are the valuations cheap enough to compensate for the additional risks ?

p.s. i know its a little early yet but intrasoft looks interesting ,400 crores of cash vs 100 cr of mkt value and realtively low debt, operates 123greetings . com ( yeah yeahi apologise ben i no u r gonna say its look pulling investors by their own boot strings, but its still worth a look right?....lol...in case u r wondering wot im reffering to check the intelligent investor 4 details)

BEERS,

Neeraj , your profile doesnot come up in any of these school websites you have mentioned

- anil

Wow! Amazing research Anilji..

Are you telling me this just as a piece of info or r u implying somethn?

If its just as a piece of info, thnx for the scoop! If u r implying sumthn, plz, khul ke boliye..i dont mind! :-)

Cheers!

Neeraj

I am curious on your age and experience, so looked up , but I did not see the profile, so if you care to explain great otherwise i respect your privacy

Anil

unless ofcourse you are visiting faculty, then i can understand

Anil

Anilji,

Yes, i teach as a visiting faculty for the past 4 years. Do go thru my introductory post (my first post on the blog), whr i have mentioned it..

cheers!

Neeraj

And ya, if u have any personal question, u can always email me on research.neeraj@gmail.com

cheers!

Neeraj

Hi Neeraj,

would it be ok to bounce of ideas on this email you have provided?

abhijeet

Absolutely man..no issues at all..

cheers!

Neeraj

Post a Comment