What is representativeness heuristic?

A representativeness heuristic is a bias in which an individual categorises a situation based on a pattern of previous experiences or beliefs about the scenario.

Umm, if that was a bit heavy, visualise this:

You see a person on the road. He is wearing a starched extra-white shirt (shirt not tucked in). He has an expensive cellfone is his hand. There is a very visible thick gold chain in his neck and an equally thick gold bracelet in his wrist. He is also wearing numerous bejeweled gold rings in his fingers and has a big tika on his forehead. Got the picture in mind? Well, if you suck at visualising stuff, its someone like this:

Now I ask you; What do you think does a person like this do?

a) Software Engineer

b) A local neta of a political party

Chances are, you will choose option b. (Btw, the person in the photo is actually an MLA from Pune)

Now is it a rule that a software engineer cannot dress like this? No! Still, we associate someone like this with a politician, based on our past observations and experience. This is representativeness heuristic. But, its not necessary that our conclusion, based on past observations, may be correct everytime..

Representative heuristic and the market

One can see this phenomenon happening in the market a lot of times. Some examples:

- Tata Steel declares phenomenal quarterly results and on that day, all steel stocks prices hit the roof. (just an example, but it happens in a lot of sectors)

- IIP numbers show consumer durables sector doing well and all consumer durable stocks go up on that day. (has happened recently)

- Rubber prices come down for a brief period and all tyre stocks go up.

Now, it should be noted that in this phenomenon, all related stocks go up, including the ones which do not deserve to! One can see the representativeness bias in the market on numerous occasions..

Representative heuristic and delisting

Finally! Coming to the point!

In Feb 2011, Altas Copco announced its intention to delist. What followed was very surprising and quite rare in the Indian market.. The promoters were fair and generous to the minority shareholders! ;-) They gave an excellent exit price to the minority. (Also, hats off to JM Financial guys for managing this delisting beautifully!)

Now this is where the representativeness bias has creeped in, imho..

The market seems to think that

1) Just like Copco, all MNCs will be fair and generous to the minority.

2) Hence it makes sense to buy all these delisting stories and make a killing!

If you think that this is not what the market thinks, look at the price movement in such stocks, after Copco's delisting succeeded..

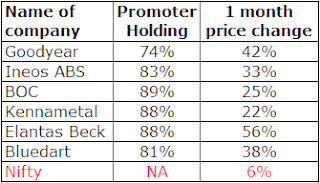

|

| Data sourced from Edelweiss Website. In some cases, the calculation seems inaccurate. Anyways, I am not interested in strict numbers, but in what they represent. |

As can be seen, after Copco's generous-hence-successful delisting, the other delisting candidates have shot up, outperforming the index. This is indeed representative bias..

So what do we do about it?

- It could very well be the case that what the market thinks is right and the MNC parents of these delisting candidates will be as generous as Atlas Copco. However, it is not necessary! Just because Atlas Copco was generous does not mean everybody will be equally generous.

- One should adopt a logical approach towards analysing delisting cases and not be swayed or affected by biases. Dont take things for granted! More on playing delisting cases here.

Cheers and happy investing!